Education is expensive.

Saving for university can be challenging. So we contacted the best financial blogs on the internet and asked them one simple question.

“What is your best tip for helping parents save for university or a child’s education?”

Let’s dive deep into your options to make saving for university more affordable while keeping the family finances in mind.

A big thanks to John at Frugal Rules, Michelle at Making Sense of Cents, Kelan and Brittany at The Savvy Couple, Dale at Cut the Crap Investing, and Barry at Money We Have for their input and helping make this article the resource it is.

Disclaimer:

This article is presented as an educational resource and should not be taken as individualized investment advice. It is also not a recommendation to buy or sell specific securities or make specific investments. The strategies discussed here are examples only and may not be appropriate for your individual circumstances.

Any investment can result in losses during any period of decline in the broad stock and bond markets. There is a risk of loss with any investment. It is an individual’s responsibility to do their own due diligence before investing.

Include your children in the decision-making process

“As with many things related to personal finance, starting as soon as possible is often the best tool to save for your child’s college education. There is limited time to save for your children, so you want to maximize it as much as possible. For our children, we opened 529 plans for each of them within a year of them being born. This allowed us to begin saving in small amounts and for grandparents to contribute funds.”

“As your children grow older, don’t overlook including them in the decision-making process. It is their education after all, so you want to include them to help guide them through the process. This offers invaluable learning opportunities related to what things cost, not to mention what they want to do for a profession. You never know, you might even be able to identify low-cost options for them to train in fields they’re interested in before it’s time for them to leave for college.” – John Frugal Rules

Start early and ask grandparents to contribute

I’ve broken up John’s quote into a couple of paragraphs that highlight his two points. The first point hit home when he mentioned grandparents contributing. It’s something my grandparents did for my education and it’s something my parents and in-laws do for my kids now.

Especially with our kids being young they only need so many toys. So we asked the grandparents that whatever they would have spent anyway could they contribute to their university savings instead. They still typically get chocolate from them as well but the kids don’t remember who gave them what present at 2 years old anyway. Getting an extra boost of money when it has so much time to run up compound interest is a great boost to their education savings.

Get them involved in the decision-making process

I like this tip a lot. As a person who has run the gamut of careers and post-secondary institutes – one of my biggest regrets is not taking the time to recide what I wanted to do with my life. In grade 9 we had a career planning assignment. I had just gone to physio for a hockey injury and he fixed my leg after a misdiagnosis from a doctor. I thought that was amazing and so I chose physiotherapist for my assignment and it stuck.

I did not enjoy the schooling. I didn’t realize the education path it would take and I was not prepared for it. Physiotherapy is a fine career but it wasn’t for me. If I had taken that time I would have had a chance to realize that.

I’ve also been to a trade school and worked as an apprentice electrician. I delivered uniforms and cleaned a city pool and now I estimate in construction.

I wish I had slowed down and looked at my options. I wish somebody had helped me through what things are important to consider with a career and schooling.

- What is the work environment like?

- What are your career options after graduating?

- What is the average salary like?

- Are jobs only available in major cities?

- What are the hours of that career like?

- Are there remote opportunities?

- How long does the schooling take?

- How much does the school cost?

I have nothing against university. For some, it is the right decision. For others like me, it’s the wrong one. University – even in Canada – is expensive over a 4-year degree. Even more so for Americans.

The diploma I graduated with has as many career options as most 4-year university degrees. The salary is good as well. The diploma took only two years to complete – and in Vancouver it has a great reputation.

Like university, I also have nothing against trades. Like anything, there are pros and cons. Lay-offs are more common and there are fewer branching career paths. It’s also hard physical work. But the pay for electricians and plumbers is excellent. Lineman make in the 6 figures thanks to storms and overtime. The job can also be incredibly rewarding. Trades are one of the few careers where you get to see the work you’ve completed when you’re done. And in the trades, there is far less schooling – cheaper too – and you get paid as an apprentice.

There is no one best solution. University is not the best. Trades are not the best. Tech schools are not the best. Bootcamps are not the best.

They all come with pros and cons and getting your kids exposed to as many careers as possible – as early as possible – will help them to know what their options truly are. Schools do not do a good enough job of preparing kids for the reality of choosing a career and education path. We as parents have the responsibility to help guide our kids toward the right decision for them.

Are you getting ready to have a baby? Be sure to check out our budgeting calculator to see how much your baby is going to cost you over the first year.

Don’t neglect retirement savings

“My top tip for parents saving for their kid’s education is to remember to still save for your retirement as well.” Michelle of Making Sense of Cents said, “Your children can take out a loan for college, but you can’t take one out for retirement. I recommend finding a way to balance both saving for your retirement as well as college education for your children.”

I liked this tip a lot. As a parent myself it’s tempting to want to pour more of our monthly savings into saving for university costs for our kids. But what about the burden we might put on them if we are reliant on our kids to support us through retirement instead?

We all want to be great parents who make our kids’ lives better than our own. So let’s explore what happens if you route your retirement savings into your child’s savings for university instead.

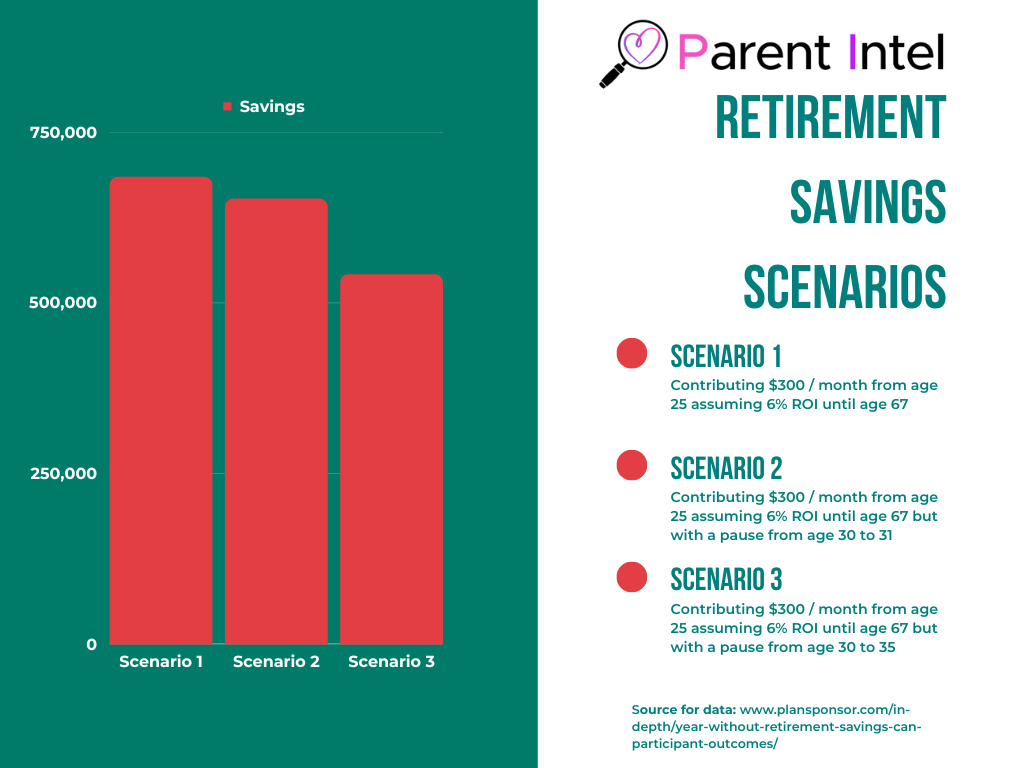

Plan Sponsor has an excellent article on their site with the 3 scenarios:

- Contributing $300 / month from age 25 assuming 6% ROI until age 67

- Contributing $300 / month from age 25 assuming 6% ROI until age 67 but with a pause from age 30 to 31

- Contributing $300 / month from age 25 assuming 6% ROI until age 67 but with a pause from age 30 to 35

Pausing retirement savings for 1 year can have an impact of over $30,000 which is about $83 a month based on a 30-year retirement. But pausing for 5 years could cost you over $142,000 in retirement – about $400 per month.

I can sympathize with parents who are put in this position to decide on saving for retirement or post-secondary education. Before you make that decision though, please be sure you’re aware of the long-term implications it will have on your retirement.

Start a side hustle with your kids

“Most parents want to do everything they can to give their children a bright future, and one of the best ways to do that is by saving for their education. Unfortunately, with the high tuition cost, saving enough can be difficult.

We recommend starting as early and contributing as often as possible. Whether you are using a tax advantage 529 plan or a simple taxable investment account you want to start building that up from a very early age. This will give you time to let compound interest work its magic on their future education funds.

Another great option is helping your children start an online business or side hustle. Instead of waiting for them to finish college teach them how to start and run a small business that they can make money with through high school and college. This can include freelancing, blogging, YouTube, SEO, social media management, etc. The options are endless in this day and age.” – Kelan and Brittany of The Savvy Couple.

I wanted to give the tip from Kelan and Brittany in its entirety as there are a couple of points that stand out as very important.

Start saving early

Starting early with a 529 plan in the US or an RESP plan in Canada is crucially important for Einstein’s 8th wonder of the world – compound interest.

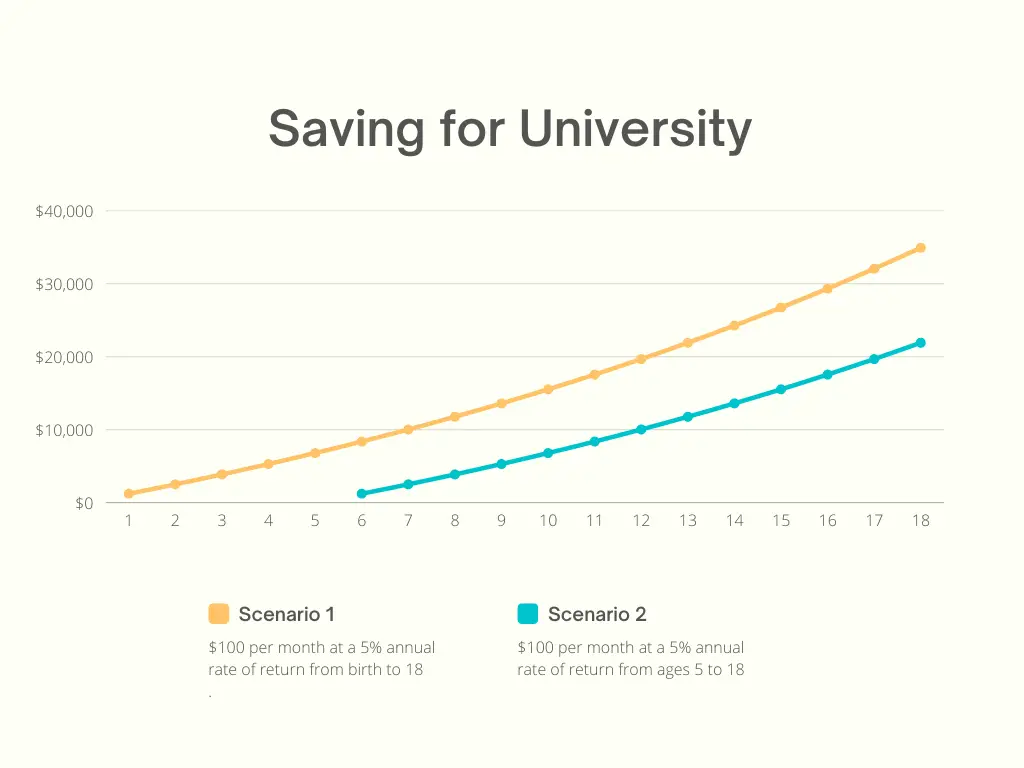

Let’s break out another graph to illustrate the point.

- Scenario 1: $100 per month at a 5% annual rate of return from birth to 18

- Scenario 2: $100 per month at a 5% annual rate of return from ages 5 to 18

- Note both scenarios are not taking into account any type of matching or government grants to simplify the point

Delaying saving for college until your child turns 5 could cost you $13,000 in savings by the time your child turns 18. Starting early with whatever you can afford is always going to be better than waiting for a better time later. Let compound interest do some of the work for you.

Start a small business with your kids

Part two of The Savvy Couple’s tip was to start an online business with your kids. I loved this tip as it’s not just a saving for university tip. Starting up a business from a young age teaches all kinds of great life skills. It gives them practical experience for any future interview. There are near endless ways to make money online these days but let’s highlight a couple I have experience with.

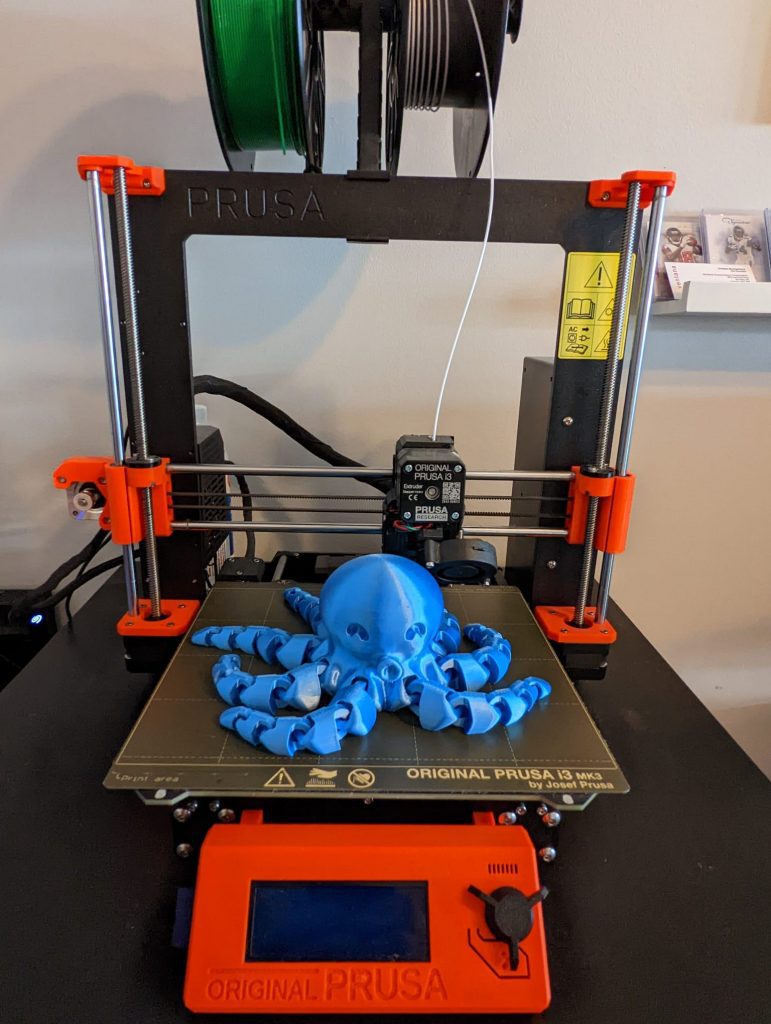

Start a 3D print shop

This is something my wife and I have done ourselves for side money over the last few years. It’s a great side business to involve your teen or young adult in it as well. Your teen could also learn some real skills and show initiative by telling the story in future interviews. I’m sure there aren’t too many kids who helped pay for their university by selling 3D prints.

To start you will need:

- A 3d printer – Ender 3 is a common starter at about $250. Prusa MK3S+ is a more reliable and feature-packed printer but costs $1,000. A nice middle ground is the Prusa mini but you’ll have to stick with smaller items. The mini is about $450. We currently use a Prusa and owned an Ender originally

- Filament to print – $30 per 1kg spool in each colour

- Designs of your own to print

- A computer to prepare files – no special hardware requirements

- Facebook marketplace or Etsy account

We’ve made money having a 3D printing service available on marketplace. We overdeliver on our products and only have high-quality prints go out the door. This has led to many repeat customers and we have made a fair bit from it.

We also did some of our designs. I followed tutorials on Youtube to learn basic 3D modelling and I was able to put together some designs for small items in a fairly short time.

The items we sold the most took 4 hours to print and sold for $20. After accounting for wastage, electricity, and filament cost we were making approximately $17 profit for 4 hours of printing and 15 minutes of our time. That’s the advantage of investing in a more reliable printer. Our Prusa works on demand and takes very little time you have to actively interact with the printer.

The most difficult part of a 3D printing service is getting your products sold. We only printed our items on demand because you don’t know which of your designs are going to sell. Etsy is a very saturated marketplace and Facebook marketplace plays games with your listings sometimes. But last Christmas on the Facebook marketplace we made about $1,200 so there is some profit to be made. We long ago paid for our printer cost and without trying to promote our service beyond marketplace listings we sold $2,500 in prints last year.

The best part about 3D printing is how easy it is to scale if you can find a niche that works for you. It simply requires adding more printers to make a print farm. Out of Darts has a blog post showing off their print farm they use to produce Nerf mods. Prusa has a print farm of 300 printers that produce many of the parts used to assemble their printers.

Flip Furniture

Another money-making method my wife and I have taken on that would be a lot of fun to do with older kids. Flip furniture!

The strategy here is simple. Find worn furniture, fix it up, and sell it.

In the picture above we picked up the table in the condition in the first two pictures. We sanded it using a palm sander to get rid of the dents, wear, and marks in the old finish. We painted the bottom level black and restained the top with natural colour. There was also a leg missing a screw to the lower level that we replaced with a 10-cent bolt from the hardware store.

We picked up this table for $10. We sold it for $100 and the total time invested to fix it was about 2 hours. Both the purchase and sale were done through the Facebook marketplace.

We did already have many of the supplies for this particular table. When you’re starting you’ll need a good all-purpose stain, rags, palm sander, sandpaper, and some basic hand tools. You can pick up all of the supplies for multiple flips for under $100.

Having a pickup truck and a garage will allow you to pick up even larger items to flip. We have flipped 4 rolltop desks as well but that’s a more advanced topic for another post. But no matter your situation or constraints you can find small items to fix up, flip and sell. And as a bonus, less perfectly good furniture in the landfill.

You have time to be aggressive and de-risk with age

“Given that the time horizon for investing for a child’s education can be 17-18 years or more, parents can and should take on investment risk for the potential of very strong returns. That is to say, they can invest in equity (stock) funds. And of course they should use the RESP program to take advantage of the $7200 of government grants available.

It is also very important to de-risk the investment portfolio as the student approaches the retirement start date. We need to sell some of the stock funds along the way and move the monies to cash and short term bonds. The portfolio should be all in cash and bonds 2-3 years previous to the education start date to remove the market risk. If a parent is not comfortable managing their own investments they can head to Justwealth who offer low-cost portfolios designed for the RESP program.

In that post you will also find a demonstration of the RESP de-risk path, for those who aim to manage their own RESP portfolio.” Dale Roberts – Cut The Crap Investing

For fellow Canadians – Take advantage of grants!

As Dale points out in his quote, take advantage of grants. If you’re a Canadian make sure you’re using an RESP to save for your child’s education. Even if you want to go the self-managed route – an RESP in Canada comes with amazing benefits. Don’t miss out on the free $7,200 and see the first link in Dale’s quote above for more information on government grants available to you.

Just listen to Dale on this one

I’m going to let Dale’s quote do the talking – he is an expert, I am not. I actually follow Dale’s investing advice for my own personal portfolio. I’ve followed Dale’s work for years and you can click the link to see his ETF Model Portfolios.

Research Scholarships

“One thing parents can do is to help their kids research scholarships. There are hundreds of scholarships out there, and they’re not always awarded to students with the highest grades. Some are given for community work or being associated with a certain organization. Sometimes it’s a straight up numbers game. If there are 100 scholarships available, but only 50 people apply, your odds are high of getting it. Scholarshipscanada.com is a good place to start looking.” Barry Choi – Money We Have

Start applying

Scholarships are one of the most underused methods of helping with university costs and so I loved Barry’s tip.

I think most people know of scholarships. But how many people actually apply for them? Global News reported in 2018 that Scholarships Canada estimated millions of dollars go unclaimed each year. The reason? Nobody applied.

It can take some time to apply but keep in mind even in essay writing you can reuse content a lot of the time. They don’t all need to be completely original essays. The section about you and what you plan to do in school isn’t going to change from one essay to the next. Reuse this portion.

Even if you spent an entire weekend applying for scholarships – if you end up with $5,000 that’s a heck of an hourly rate! Every bit counts.

A big thank you to our experts

A bit thank you to our experts. Jon, Michelle, Kelan & Brittany, Dale, and Barry you’ve made this article possible and have given it the credibility it needs.

So parents what tip did you find the most interesting? What unique methods have you taken while saving for university for your kids? Let me know in the comments – I’d love to hear from you.